Bank of America:

GOLD the last safe haven against U.S. debt disaster and the declining US dollar. - Source

GOLD the last safe haven against U.S. debt disaster and the declining US dollar. - Source

"GOLD and SILVER are MONEY. Everything else is credit."

— J. P. Morgan

Disclosure:

This website contains affiliate links.

When you click on these links and make a purchase, I may receive a commission at no additional cost to you.

I only promote companies that I have personally used or researched and believe will add value to our readers.

This website contains affiliate links.

When you click on these links and make a purchase, I may receive a commission at no additional cost to you.

I only promote companies that I have personally used or researched and believe will add value to our readers.

Disclosure: The content I provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision.

Also, note that every investment comes with its own risks and drawbacks. Lastly, I would like to remind you that past results cannot guarantee future returns.

Also, note that every investment comes with its own risks and drawbacks. Lastly, I would like to remind you that past results cannot guarantee future returns.

Why A Gold IRA?

And The US Dollar Is Declining

Billionaire Elon Musk:

"Where are we with the dollar value destruction…"

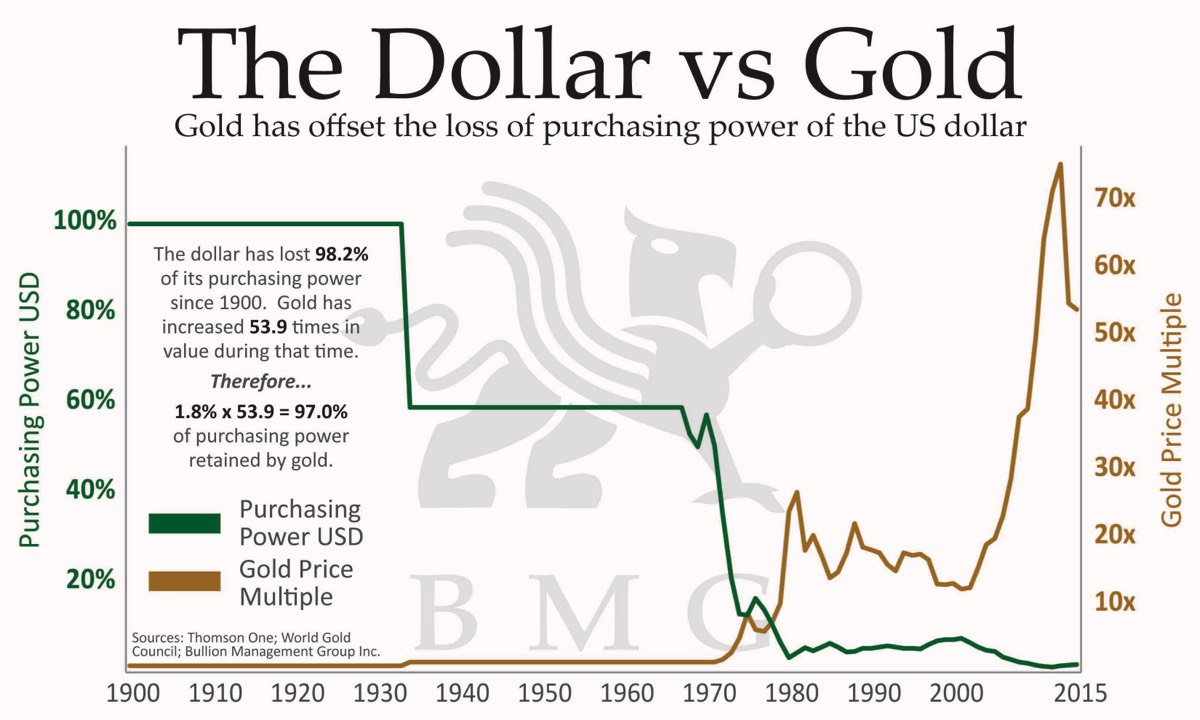

The U.S. dollar has depreciated over time, especially in terms of purchasing power.

This erosion of purchasing power is one of the most direct effects of devolution of the dollar.

Inflation can erode the value of savings if the interest rates on savings accounts do not keep pace with or exceed the rate of inflation.

Fixed income investments like bonds an paper IRAs are particularly vulnerable since inflation reduces the real return on these investments.

Conversely, certain assets like real estate or Gold might serve as inflation hedges, potentially increasing in value as inflation rises.

This erosion of purchasing power is one of the most direct effects of devolution of the dollar.

Inflation can erode the value of savings if the interest rates on savings accounts do not keep pace with or exceed the rate of inflation.

Fixed income investments like bonds an paper IRAs are particularly vulnerable since inflation reduces the real return on these investments.

Conversely, certain assets like real estate or Gold might serve as inflation hedges, potentially increasing in value as inflation rises.

Gold - A Long History Of Value

Gold’s purchasing power has remained remarkably stable in the past 400 years, but has increased in value over $1,000 in the last 2 years. ( Gold Chart )

Upcoming Crisis

The ensuing debasement of the US currency ( See GPD & US Debt ) has weakened the US Dollar and has become a concern of those with those who have invested all their saving and retirements in Paper IRAs or the stock market.

When paper currencies lose value, gold tends to increase in price. Indeed, gold has dramatically increased in value. As a result, Gold is becoming the best “money” to secure savings from 1972s onwards.

Upcoming Crisis

The ensuing debasement of the US currency ( See GPD & US Debt ) has weakened the US Dollar and has become a concern of those with those who have invested all their saving and retirements in Paper IRAs or the stock market.

When paper currencies lose value, gold tends to increase in price. Indeed, gold has dramatically increased in value. As a result, Gold is becoming the best “money” to secure savings from 1972s onwards.

Gold Has Intrinsic Value

Gold is not fiat money ( Fiat Money Explained )

((and WILL ALWAYS HAVE INTRINSIC VALUE. Wherever enterprising men seek to exchange their goods and services for more marketable goods that facilitate further exchanges for other goods, precious metals, especially gold, are most suited to serve as money.

Long History As Universal Money

For some 2,500 years small pieces of gold and silver, called coins, constituted universal money. It survived two millennia in spite of countless attempts by hosts of governments to manipulate it or replace it with their own media.

Is Gold Making A Return As Universal Money?

Good Question. But in the last in the last 12 months, Gold has rising a $1,000 in just the last 2 years, ( See Gold Chart ) is still going up, and may be the best hedge against inflation that could be lurking around the corner.

Gold is not fiat money ( Fiat Money Explained )

((and WILL ALWAYS HAVE INTRINSIC VALUE. Wherever enterprising men seek to exchange their goods and services for more marketable goods that facilitate further exchanges for other goods, precious metals, especially gold, are most suited to serve as money.

Long History As Universal Money

For some 2,500 years small pieces of gold and silver, called coins, constituted universal money. It survived two millennia in spite of countless attempts by hosts of governments to manipulate it or replace it with their own media.

Is Gold Making A Return As Universal Money?

Good Question. But in the last in the last 12 months, Gold has rising a $1,000 in just the last 2 years, ( See Gold Chart ) is still going up, and may be the best hedge against inflation that could be lurking around the corner.

Nobel Gold Investments has more than 20 years of dealing with bullion, coins, ingots, and other precious metals

They are sought out and consulted by financial agents, estate planning attorneys, and certified public accountants to advise them on all aspects of precious metals, having secured more than $200 million in precious metal assets.

With Noble Gold Investments you will be treated like an elite investor. Upon enrolling with Noble Gold, you will know who our CEO is and who you will be handing your money too.

Noble Gold sells gold & silver and also provides great service to their customers.

5 Star Consumer Rating

Paul Tudor Jones

$7.5B Net Worth

5% gold allocation

$7.5B Net Worth

5% gold allocation

Kevin O'Leary

$400M Net Worth

5% gold allocation

$400M Net Worth

5% gold allocation

Ray Dalio

$19.1B Net Worth

8% gold allocation

$19.1B Net Worth

8% gold allocation

Kyle Bass

$3B Net Worth

10% gold allocation

$3B Net Worth

10% gold allocation

Rick Rule

$133M Net Worth

10% gold allocation

$133M Net Worth

10% gold allocation

Jim Rickards

$19M Net Worth

10% gold allocation

$19M Net Worth

10% gold allocation